By Shaun Lim

As consumer behaviours change in the face of economic uncertainty, the subscription-based monetisation model for video streaming services has reached a saturation point where consumers simply cannot afford multiple subscriptions. To exacerbate the situation, account sharing, piracy and an upsurge in churn rate is steadily on the rise.

What then, are operators doing to mitigate this situation?

Adding ads as part of a hybrid model that combines subscriptions and ads is increasingly an attractive option, said Till Sudworth, Head of BU Video and Member of the Management Board at global video intelligence company NPAW.

He told APB, “Our 2023 State of Streaming Advertising and Analytics survey revealed that 76% of subscription-based streaming services globally plan to include ads by the end of 2024. Implementing a hybrid model (an ad-supported tier plus a premium, subscription-based one) is the preferred path for 59% of them — a move all these respondents agree is aimed at lowering the price of subscriptions.”

For more traditional broadcasters, there is perhaps more catching up to do, as Sudworth identified digital presence, or lack thereof, as one of the most under-utilised aspects of their businesses.

Most broadcasters, he observed, have only recently started deploying digital strategies that extend beyond the typical digital companion app that offers the same content as their flagship TV channel, live or on-demand.

“We are seeing them experimenting with digital-only content and sub-channels, whether that’s by offering free additional content with ads, or by including exclusive add-ons for premium-tier customers,” Sudworth added.

“Currently, we are witnessing an explosion of new content and formats that are digital-first and created to fit these hybrid strategies, coupled with improved digital app experiences akin to what leading streaming platforms are offering.”

With new channels and content offering the potential to tap into fresh customer segments and increase engagement among existing customers, changes are driven by opportunities to increase revenue and audience engagement.

To achieve real success, Sudworth advised broadcasters to ensure they are utilising their content in the best possible way by partnering with external platforms through content syndication and distribution agreements. Additionally, they should tap into as many platforms and channels as possible to monetise their content, communicating with different audiences where they are and in the media language they speak.

“All in all, this is a growth model that aligns well with the outlook for the year ahead. This is particularly true for free, ad-supported options that offer additional ad impressions and revenue without burdening consumers during times of economic uncertainties and growing subscription fatigue,” he added.

To drive a sustainable and profitable advertising business, media operators should start by understanding their total audience and inventory, said Steve Reynolds, President, Imagine Communications.

Cross-platform selling, planning, and optimisation, he explained to APB+, all work better when there is a single inventory management platform that has visibility to leverage placement opportunities across linear, on-demand, streaming, and addressable delivery.

“To start down this path, media companies and operators need to have a modern, robust inventory management system that is connected to all of those delivery platforms,” said Reynolds.

“That inventory management system serves as the nexus between a cross-platform order management system (OMS), the optimisation modules that are tuned for each delivery type, demand sources, and the data sources that provide details about viewership, ratings, delivery performance, and audience.

“The inventory system must also provide the critical link to the billing and general ledger platforms, ensuring that proof-of-performance and affidavit requirements are met.”

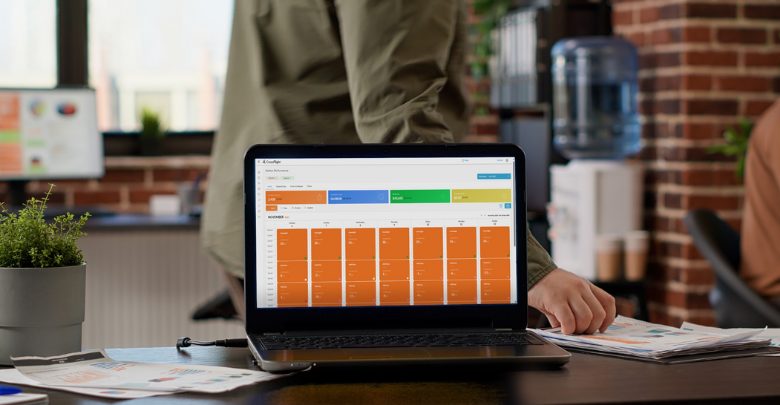

To provide a consistent and cohesive set of business rules from the inventory system to the OMS, Imagine is offering its CrossFlight OMS, a cloud-based broadcast sales platform that automates management of ad sales, proposals, pricing and audience forecasting.

Orders that are then placed via the OMS can fully reflect the types of campaign plans that have long driven value for linear inventory, including brand safety, category separation, time-of-day rules, and fixed placements for sponsorships.

Furthermore, as regulatory and privacy rules evolve around the globe, this model will ensure that brands can buy advertising in a way that is safe, effective, and compliant with local laws and restrictions.

To address the common complaint of viewer fatigue associated with what Reynold described as the “very poor management of ad load in the current generation of Connected TV (CTV) systems,” Imagine is also focused on bringing broadcast-grade ad decisions to digital and CTV.

He explained, “Many of the ad servers currently deployed in that segment are simply unaware of the business rules that support premium ad rates. These systems were simply not designed to operate cohesively with linear delivery, so they will require significant adaptation to fit into a true cross-platform, converged inventory and audience model.

“The newest generation of CTV ad decisions servers – such as the SureFire ADS from Imagine – are designed and implemented specifically to fit into the cross-platform future. SureFire was built from the ground up to provide linear-like control of digital inventory and to do this at a massive scale. Add to this the ability to seamlessly integrate into a cross-platform inventory management and optimisation system, and the path towards more profitable and sustainable CTV ad revenue becomes clearer.”

Improved profitability, Reynolds was quick to add, also extends to the linear side of the converged advertising model. While there has been a slow decline in linear ad spending in some markets, Imagine continues to see substantial growth in linear ad revenue in markets that have moved towards trading linear on an audience basis.

Commending this as a “simple yet very elegant” concept, he explained, “Instead of selling fixed spots in the schedule, operators are now able to represent their inventory as being an audience that can be dynamically traded and scheduled by an optimisation engine. This yields significant improvements for both the buyers and sellers of advertising.

“The buy-side gets a more predictable and effective delivery of their campaign goals (audience segments, reach, frequency, pacing), and the sell-side gets better utilisation of inventory and better yield from linear orders.”

Looking ahead, Imagine envisions a future where advertising is a converged model that brings together the entire audience by re-aggregating viewership across multiple platforms instead of eroding value through fragmentation.

“By creating a cross-platform environment that includes the OMS, the inventory management system, a CTV decision server that brings the premium of linear-like selling to digital, and a linear optimisation system that enables digital-like selling of audience for linear, we are creating an advertising platform that enables sustainable, scalable, and profitable growth for media companies around the globe,” Reynolds concluded.

Where ad-supported business models are concerned, the recent emergence of Free Advertising Supported Television (FAST) has been touted in many quarters as a potential game changer.

When it comes to driving better content monetisation, building a FAST channel and Dynamic Ad Insertion (DAI) rank as the two key approaches for many broadcasters, according to Jay Ganesan, SVP, Asia-Pacific, Amagi.

He highlighted to APB+, “Broadcasters with an over-the-air (OTA) signal are already delivering free, ad-supported television, so putting that content on FAST only means that more people will see it.

“Many viewers continue to experience fatigue and discoverability issues with video-on-demand (VoD) services, yet the cord-cutting trend still shows no signs of stopping. FAST presents a wonderful middle-ground, enabling content owners to capitalise on the high demand for premium content while offering linear experiences akin to cable or broadcast.”

A DAI solution, meanwhile, can further enhance ad revenue for all linear TV formats by delivering personalised and relevant ads on a large scale. The primary goal of implementing DAI, said Ganesan, include enhancing viewer engagement, increasing cost per mile (CPM), and reducing ad fatigue.

“In fact, DAI facilitates the strategically placement of non-linear ads — such as graphic overlays — into video programmes, allowing channel owners to precisely control when and where these ads appear.

“With the ability to replace TV ads in real-time with personalised and targeted content, DAI is a powerful tool that can help broadcasters adapt to changing viewer preferences.”

It is however, the rise of FAST, that will truly revolutionise not only how broadcasters monetise their content, but how they reach a broader audience, declared Ganesan.

To find out why this is so, and to gain more insights into how broadcasters can maximise their revenue across multiple platforms in 2024, be sure to read part two of this special Taking Stock report by APB+.