By Shaun Lim

As 2024 begins winding down its tumultuous year, profound reflections are on the agenda for many organisations and businesses as they reflect on what has been and set goals for 2025 and beyond. The satellite broadcasting industry is no exception.

Driven by technological advancements and evolving consumer preferences, the satellite broadcasting industry has undergone significant transformation in 2024, reflected Maxime Puteaux, Principal Advisor, Novaspace.

Speaking to APB+, he said, “Traditional direct-to-home (DTH) services are facing challenges from over-the-top (OTT) platforms and streaming services, leading to a gradual decline in linear TV viewership. However, satellite broadcasting remains vital for delivering content to regions with limited terrestrial infrastructure.”

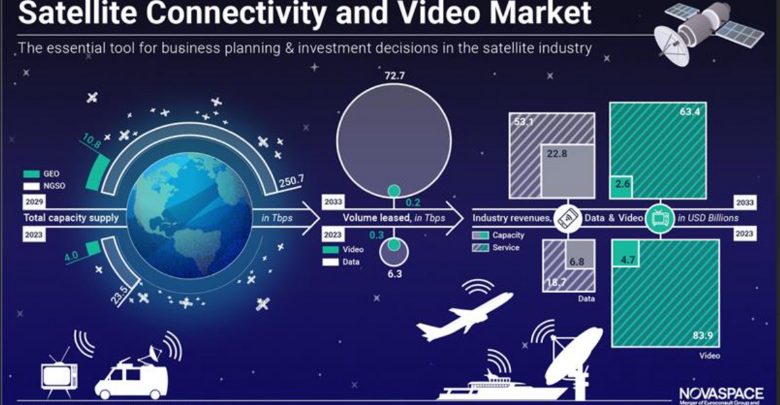

This, despite the fact that the satellite broadcasting industry has seen service revenues decline in recent years, dropping from US$114 billion to an estimated $103 billion in 2023.

Puteaux attributed the decline to factors such as stagnation in video growth markets such as South Asia and delays in deploying next-generation satellite systems, such as Non-Geostationary Orbit (NGSO) and Very High Throughput Satellites (VHTS). “These delays and shifting customer preferences, especially in regions previously showing strong video demand, have contributed to a setback in the anticipated return to revenue growth,” he added.

Despite these challenges, Puteaux predicts an optimistic future where recovery and growth will be driven by an expanding addressable market and new use cases.

Key drivers, he said, include rising demand in the mobility and defence segments, as well as the potential of multi-orbit services that allow operators, especially vertically integrated ones, to capture a greater share of the value chain.

Another potential growth area is the data segment, which is projected to grow at a compound annual growth rate (CAGR) of over 10% over the next decade. “This growth is supported by the expansion of satellite communication (satcom) use cases and the anticipated contributions from multi-orbit revenue streams, potentially pushing industry revenues to $117 billion by 2033,” Puteaux said.

For Intelsat, 2024 represented a significant milestone when the satellite services provider celebrated its 60th anniversary.

Describing Intelsat’s journey so far as one that has shaped by dedication, resilience, learning and growth, as well as the building of lasting relationships, Gaurav Kharod, Regional Vice-President, Asia Pacific, Intelsat, told APB+, “Intelsat's journey from its humble beginnings to its current position is marked with key milestones including increasing trans-Atlantic telephone lines, broadcasting countless historical events from Olympic Games, the Apollo Moon Landing and royal weddings to connecting millions of people to the broadband no matter how remote their locale.

“Our groundbreaking accomplishments from the past are directly tied to our present and future successes. For example, Intelsat is building the world’s first, truly global and unified 5G network, which offers a seamless, virtualised unified network and ecosystem.”

Like Novaspace’s Puteaux, Kharod is convinced that the future of satellite broadcasting is bright, albeit being driven by evolving dynamics shaped by new technologies and emerging platforms.

Satellite, he emphasised, remains a stable backbone for traditional TV broadcasting and remains the most reliable way to deliver high-quality TV signals. “Satellite’s global reach and reliability offer key advantages which are particularly attractive to international broadcasters and news services,” Kharod said. “It supports high-quality video and audio transmission, including 4K and high dynamic range (HDR) content, and plays a significant role in the delivery of live sports events, news, and large-scale entertainment broadcasts.”

New satellites are also adapting to evolving video standards by supporting higher bandwidths and more efficient compression technologies. “So, while the role of satellite in broadcasting is being reshaped by technological advancements and the rise of internet streaming, satellite remains a core part of the broadcast ecosystem,” Kharod said.

Satellite the go-to delivery platform for content in Asia

With its vast and diverse geography, which includes remote and underserved areas where terrestrial infrastructure is limited or non-existent, satellite broadcasting remains highly relevant and the most effective platform to deliver content to multiple households.

Novaspace’s Puteaux explained, “Satellites provide a cost-effective means to deliver content across these regions in bridging the digital divide and meeting the region's increasing demand for content and connectivity.”

“In parallel with satellite broadband rollout, broadcasting opportunities include: expansion of DTH services targeting the growing middle-class population seeking diverse content, broadcasters transitioning from analogue to digital services, enhancing content quality and variety. Backhaul services for mobile networks and supporting broadband initiatives in rural areas is also a growing segment.”

With a wholly-owned subsidiary expected to be opened in India before end-2024, Intelsat is perhaps best placed to appreciate the dominant nature of how the country consumes satellite content.

For context, Intelsat partners with key programmers in India to deliver more than 300 premium channels to over 700 million viewers, a feat made possible by the deployment of cutting-edge satellite technology to dispersed locations across India, including those in hard-to-reach and connectivity-challenged locations.

However, Intelsat’s Kharod cautioned, “While satellite distribution is still the primary mode of delivery of content in India, there’s no denying that alternative platforms are proliferating.

“Legacy broadcasters everywhere continue to face intense pressure from streaming services and non-traditional, internet-based content creators. It is important to continually adapt to new technologies and consumer demands.

“A lot of times, while alternative platforms are enticing for the advertising opportunities, they are still best paired with traditional pay-TV services to maximise value and reach.”

Meanwhile, Intelsat’s global multi-vertical space continues to grow, driven by a deep-rooted presence in India. Significantly, Intelsat’s video neighbourhoods provide programming to India that represents half the market TV content that is distributed to the millions of households in India.

Satellite distribution, thus, is critical for otherwise under-reached people in India’s rural areas. Besides bridging the socioeconomic information gap and promoting economic, cultural and educational development, television content also brings families and communities together to enjoy entertainment experiences, often through a single, shared television, Kharod highlighted.

As for what technologies will have the greatest impact on the satellite broadcast industry in the near future, Novaspace’s Puteaux said, “The challenges facing satellite operators is in adapting to the competitive landscape by investing in new technologies and exploring hybrid models that combine satellite and IP-based delivery.”

IP distribution, he added, will facilitate the convergence of satellite and internet protocols, enabling more flexible and scalable content delivery models. 5G integration, meanwhile, offers opportunities for satellite networks to complement terrestrial 5G deployments, especially in extending coverage to remote areas.

And then there is free-ad supported streaming TV (FAST), which has made rapid advancements in 2024 that are showing little signs of abating. “FAST presents both competition and collaboration prospects, as satellite operators can distribute FAST channels to broaden their content offerings,” Puteaux said.

Intelsat’s Kharod goes a step further by predicting that FAST channels will increasingly be drawn to satellite-based distribution.

He explained, “While FAST offerings are typically supported on IP Networks, the concept of free advertising supported television existed on satellite-based distribution networks under the acronym of free-to-air (FTA). The advent of FAST, along with all the statistical data on consumer preferences and habits, has also spurred similar statistical solutions on satellite-based FTA channels.”

The allure of FAST platforms, Kharod proposed, can be attributed to the availability of international, as well as unique, content that often cannot be found anywhere else. With 32% of internal users across the Asia-Pacific region already owning a connected TV, seven out of 10 viewing a connected TV in Indonesia and eight out of 10 in Australia, as well as close to 80% of streaming TV viewers in India preferring to watch ad-supported content as opposed to subscribing to ad-free subscription video-on-demand (SVoD) services, the stage appears set for FAST platforms to continue growing.

“These numbers show an already sizeable audience and is expected to grow as TVs continue to become more affordable,” Kharod added.

Transformation, growth & consolidation key buzzwords in 2025

Like any industry, the satellite broadcasting industry will have to contend with a number of challenges and opportunities in 2025.

Novaspace’s Puteaux presents a number of key trends to take note of:

- Proliferation of Low Earth Orbit (LEO) constellations: The deployment of LEO satellites is expected to increase, providing low-latency broadband services and expanding global connectivity.

- Advancements in satellite technology: The launch of the first Geostationary Equatorial Orbit (GEO) comsat software-defined satellites will offer greater flexibility and efficiency in operations.

- Integration with 5G networks: Satellites will play a crucial role in complementing 5G networks, particularly in providing coverage to underserved regions.

- Growth in satellite-based Internet of Things (IoT): The demand for IoT connectivity via satellites is projected to rise, supporting applications across various industries.

- Industry consolidation: Mergers and acquisitions among satellite operators and service providers may increase as companies seek to enhance capabilities and market reach.

Puteaux added, “Regulatory considerations, such as spectrum allocation and orbital slot management, will also play a crucial role in shaping the industry's future.”

While continuing to evolve its platforms to support more FAST channels, Intelsat will continue to build on the progress that IntelsatOne IP has made in 2024. Intelsat’s own IP-based global terrestrial distribution and contribution network, IntelsatOne IP, among its achievements, showcased transport of live video feeds from the 2024 Summer Olympics, and demonstrated lower latency and higher efficiency when compared to transporting over the public Internet.

Kharod said, “While satellite broadcasting continues to be a cornerstone of distribution, the media industry will continue to transform with a growing trend towards IP distribution, and hybrid distribution solutions powered by multiple satellites and terrestrial services such as fibre, IP and cloud.

“The market, I have no doubt, will continue to offer new ways to deliver and consume content.”